When choosing a bank, protecting your money is a top priority. A common question is, “Is CIT Bank FDIC insured?” This guide explores the importance of FDIC insurance, its application to CIT Bank, and the reasons you should prioritize banks with FDIC coverage to safeguard your funds.

What is FDIC Insurance?

The Federal Deposit Insurance Corporation (FDIC) is a U.S. government agency created in 1933 to maintain public confidence in the banking system. It provides insurance for deposits made in member banks, ensuring that depositors are protected if a bank fails.

Key Features of FDIC Insurance

- Coverage Limit: Insures deposits up to $250,000 per depositor, per bank, per ownership category.

- Types of Accounts Covered:

- Checking Accounts

- Savings Accounts

- Money Market Deposit Accounts (MMDAs)

- Certificates of Deposit (CDs)

In case of bank failure, the FDIC refunds deposits up to the insurance limit.

Is CIT Bank FDIC Insured?

Yes, CIT Bank is FDIC insured, which means your eligible deposits are protected up to the FDIC’s insurance limit of $250,000. This is crucial for customers seeking assurance that their money is safe in case of unforeseen events.

Why FDIC Insurance Matters

FDIC insurance provides several key benefits when evaluating any financial institution:

- Protection Against Bank Failure: Bank failures, while rare, can happen. If CIT Bank fails, your money remains protected up to the insured limit, which is especially important during uncertain economic times.

- Security for Large Deposits: Depositors find peace of mind knowing that their funds stay safe even if a bank encounters financial instability. If you plan to deposit a substantial sum at CIT Bank, understanding the insurance limit and ways to maximize coverage is vital.

- Backed by the U.S. Government: FDIC insurance is backed by the full faith and credit of the United States government, offering reliability and trust.

- No Extra Cost to Depositors: FDIC insurance comes at no extra cost to depositors. CIT Bank pays the FDIC premiums, so you benefit from FDIC protection without paying fees.

How FDIC Insurance Works at CIT Bank

CIT Bank provides FDIC insurance that covers deposits according to ownership categories:

- Individual Accounts: Each account in your name is insured up to $250,000.

- Joint Accounts: Each co-owner is insured up to $250,000, allowing for coverage of up to $500,000 total for joint accounts.

- Retirement Accounts (IRAs): IRAs are insured separately from other deposit accounts.

Important Note

FDIC insurance applies to deposits at the bank as a whole, not to individual branches.

Maximizing FDIC Coverage at CIT Bank

If you have deposits exceeding $250,000, here are strategies to increase your FDIC insurance coverage at CIT Bank:

- Open Accounts in Different Ownership Categories: The FDIC insures funds held in various ownership categories separately. For example, individual, joint, and trust accounts receive separate coverage.

- Use Multiple Banks: You can spread deposits across other FDIC-insured banks to secure more protection.

- Create Trust Accounts: Trust accounts receive separate coverage based on the number of beneficiaries, allowing greater protection for family members.

- Remember, Branches Don’t Affect Coverage: The FDIC insures deposits per bank, not per branch. Whether you deposit at one branch or multiple locations, your deposits are aggregated for insurance purposes.

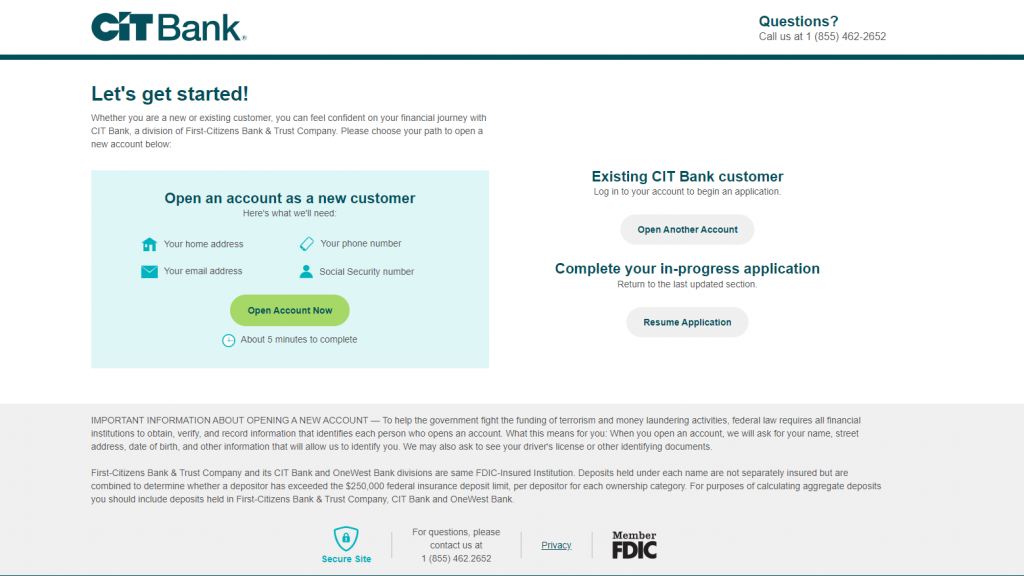

How to Verify CIT Bank’s FDIC Status

To verify CIT Bank’s FDIC membership, use the FDIC’s BankFind tool. By entering CIT Bank’s name, you can find its FDIC number and details. You can also visit CIT Bank’s official website for information regarding its FDIC status.

What FDIC Insurance Does Not Cover

While FDIC insurance offers robust protection, it doesn’t cover all accounts and investments. The following aren’t insured by the FDIC:

- Investment Products: Stocks, bonds, and mutual funds.

- Insurance Products: Life insurance policies and annuities.

- Securities: Municipal securities.

These products carry their own risks, as their value can fluctuate.

FDIC Insurance for Online-Only Banks

Many wonder if online-only banks like CIT Bank offer the same FDIC protection as traditional banks. The answer is yes. FDIC regulations apply equally to online banks like CIT Bank. Your deposits are fully protected, whether made online, through a mobile app, or by phone.

Final Thoughts: Confidently Banking at CIT Bank

CIT Bank’s FDIC insurance provides essential protection, ensuring your deposits are safe, even if the bank fails. Whether opening a checking account, savings account, or CD, you can confidently deposit your funds, knowing the FDIC covers them up to $250,000.

Frequently Asked Questions (FAQs)

1. Does FDIC insurance cover multiple accounts at CIT Bank?

Yes, FDIC insurance covers multiple accounts at CIT Bank, but the coverage is capped at $250,000 per depositor, per ownership category.

2. Can I insure more than $250,000 at CIT Bank?

Yes, you can insure more than $250,000 at CIT Bank by using different ownership categories (e.g., joint accounts) or by spreading deposits across multiple FDIC-insured banks.

3. How do I know if my CIT Bank deposits are FDIC insured?

You can confirm CIT Bank’s FDIC insurance status through the FDIC’s BankFind tool or by visiting CIT Bank’s official website.

4. Are online-only banks like CIT Bank FDIC insured?

Yes, online-only banks like CIT Bank provide the same FDIC insurance protection as traditional banks.