In today’s fast-paced world, understanding insurance is essential for safeguarding your assets and ensuring financial stability. “Insurance Cafewessel” encapsulates a wide range of insurance products and services tailored to meet diverse needs. Whether you are looking for health insurance, auto insurance, or business insurance, this comprehensive guide covers everything you need to know about Insurance Cafewessel.

1. What is Insurance Cafewessel?

1.1 Definition of Insurance Cafewessel

Insurance Cafewessel refers to a variety of insurance solutions customized to individual and business needs. This includes coverage options ranging from health and life insurance to auto and property insurance, aiming to provide a holistic approach to risk management.

1.2 Importance of Insurance Cafewessel

Insurance Cafewessel is vital for mitigating risks associated with unforeseen events. It acts as a safety net, ensuring that you and your family are financially protected during crises.

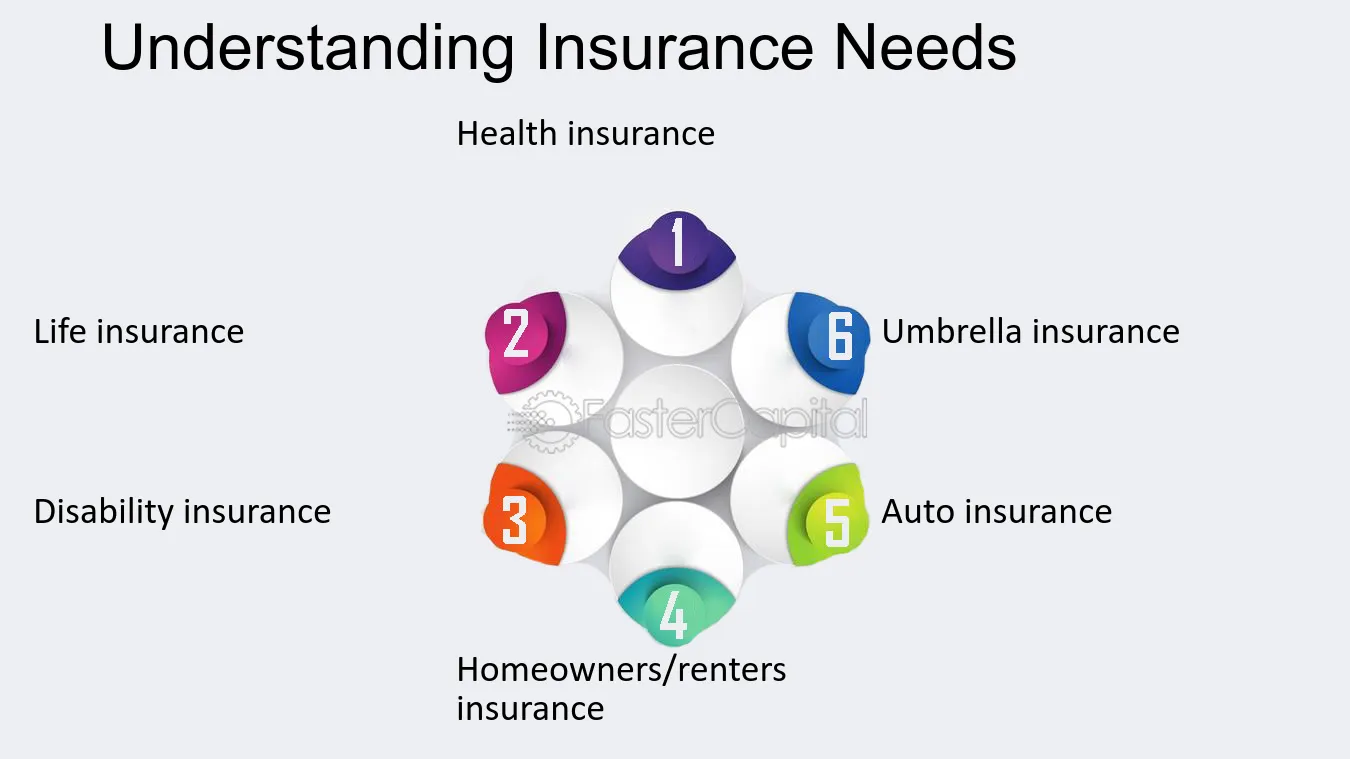

2. Types of Insurance Offered in Cafewessel

2.1 Health Insurance

Health insurance is one of the most critical types of coverage available. It covers medical expenses and provides access to healthcare services. Understanding the various health insurance plans can help you choose the right one for your needs.

2.2 Auto Insurance

Auto insurance protects you from financial loss in the event of an accident or theft. In Cafewessel, several types of auto insurance policies are available, including liability, collision, and comprehensive coverage.

2.3 Homeowners and Renters Insurance

Homeowners and renters insurance is designed to protect your property from damages and losses. It covers personal belongings and provides liability protection, making it an essential part of any comprehensive insurance strategy.

2.4 Life Insurance

Life insurance offers financial security to your loved ones in the event of your passing. There are two main types: term life insurance and whole life insurance, each serving different purposes.

2.5 Business Insurance

Business insurance is crucial for entrepreneurs and business owners. It protects against various risks, including property damage, liability claims, and employee-related issues. Different policies can be customized to fit specific business needs.

3. Understanding Insurance Policies

3.1 Policy Types

Understanding different insurance policy types can help you make informed decisions. Policies can be categorized as:

- Comprehensive Policies: Cover a wide range of risks.

- Basic Policies: Offer limited coverage at a lower cost.

3.2 Premiums and Deductibles

Premiums are the monthly or yearly payments you make for coverage, while deductibles are the amount you pay out of pocket before your insurance kicks in. Knowing how these factors affect your overall costs is essential for budgeting.

4. How to Choose the Right Insurance Policy

4.1 Assess Your Needs

Before selecting an insurance policy, assess your individual or business needs. Consider factors such as financial stability, risk tolerance, and specific coverage requirements.

4.2 Research Insurance Providers

Researching various insurance providers can help you find the best options. Look for companies with a strong reputation, positive customer reviews, and competitive rates.

4.3 Compare Quotes

Comparing quotes from different insurers is crucial for finding the best deal. Utilize online tools to get multiple quotes, and don’t hesitate to negotiate terms.

5. The Role of Insurance Agents

5.1 Benefits of Using an Insurance Agent

Insurance agents can provide invaluable assistance in navigating the complex world of insurance. They offer personalized advice and help you find the best policies for your needs.

5.2 Types of Insurance Agents

There are two main types of insurance agents:

- Independent Agents: Work with multiple insurers to provide various options.

- Captive Agents: Represent a single company and focus on their products. Each type has its advantages and disadvantages.

6. Common Myths About Insurance

6.1 Myth: Insurance is Too Expensive

Many people believe that insurance is too costly. However, affordable options are available, and the right coverage can save you money in the long run.

6.2 Myth: I Don’t Need Insurance

Some individuals think they don’t need insurance until a significant event occurs. However, having insurance is essential for protecting against unforeseen risks.

7. Legal Aspects of Insurance

7.1 Insurance Regulations

Understanding the legal framework governing insurance is crucial. Insurance regulations vary by state and country, impacting coverage requirements and policyholder rights.

7.2 Claims Process

Filing an insurance claim can be complex. Familiarizing yourself with the steps involved can help ensure a smoother experience when you need to utilize your coverage.

8. Future Trends in Insurance Cafewessel

8.1 Technological Advances

The insurance industry is continually evolving with technological advancements. Insurtech solutions, including AI and data analytics, enhance customer experiences and streamline operations.

8.2 Customized Insurance Products

As consumer needs change, so do insurance products. The rise of customized and on-demand insurance policies is making it easier for individuals to find coverage that suits their specific requirements.

9. Frequently Asked Questions (FAQs)

9.1 What is the best type of insurance for individuals?

The best type of insurance depends on individual needs, but health, auto, and life insurance are generally recommended for most people.

9.2 How can I lower my insurance premiums?

You can lower your premiums by shopping around for quotes, raising your deductible, and maintaining a good credit score.

9.3 What should I do if my claim is denied?

If your claim is denied, review the denial letter, contact your insurance provider for clarification, and consider appealing the decision if necessary.

10. Conclusion: Your Path to Financial Security with Insurance Cafewessel

In summary, understanding and choosing the right Insurance Cafewessel is crucial for protecting your financial future. By assessing your needs, researching options, and staying informed about industry trends, you can make confident decisions regarding your insurance coverage. Whether you are a business owner or an individual, the right insurance policies can provide peace of mind and safeguard your assets.